Kanis Saengchote. Associate Professor at the Department of Banking and Finance, Chulalongkorn Business School.

Please check here for my latest research interests. I am currently fascinated by factor investing, spatial analytics, and FinTech.

Substack: การเงินสำหรับคนช่างสงสัย

กลยุทธ์การเงิน สำหรับผู้บริหาร 101 | The Secret Sauce

เงิน: อดีต ปัจจุบัน และอนาคต

หนังสือเล่มนี้ได้รับการสนับสนุนการจัดทำและตีพิมพ์โดยแผนงานยุทธศาสตร์เป้าหมาย (Spearhead) ด้านสังคม คนไทย 4.0 สนับสนุนโดยสำนักงานการวิจัยแห่งชาติ (วช.) และตลาดหลักทรัพย์แห่งประเทศไทย

ISBN: 978-616-398-718-1

พิมพ์ครั้งที่ 1 กรกฎาคม 2565 1,200 เล่ม (คลิกเพื่อดาวน์โหลด)

พิมพ์ครั้งที่ 2 กันยายน 2566 500 เล่ม (คลิกเพื่อดาวน์โหลด)

คำนำผู้เขียน การพิมพ์ครั้งที่ 2

หนังสือ เงิน: อดีต ปัจจุบัน และอนาคต ตีพิมพ์เผยแพร่ครั้งแรกเมื่อเดือนกรกฎาคม พ.ศ. 2565 โดยได้รับการสนับสนุนจากแผนงานยุทธศาสตร์เป้าหมาย (Spearhead) ด้านสังคม คนไทย 4.0 สนับสนุนโดยสำนักงานการวิจัยแห่งชาติ (วช.) และตลาดหลักทรัพย์แห่งประเทศไทย และได้รับการตอบรับอย่างดี

การพิมพ์ครั้งที่ 2 ยังคงเนื้อหาเช่นเดียวกับฉบับพิมพ์ครั้งแรก โดยไม่มีการเปลี่ยนแปลงในโครงสร้างหรือสาระสำคัญ อย่างไรก็ตาม ได้มีการปรับแก้ข้อผิดพลาดด้านการสะกดคำและการใช้ภาษาเพื่อให้หนังสือมีความถูกต้องสมบูรณ์ยิ่งขึ้น ทั้งนี้ หมายเลขหน้าของเนื้อหายังคงเหมือนเดิม

ผู้เขียนขอขอบคุณ ศาสตราจารย์ ดร. มิ่งสรรพ์ ขาวสอาด แผนงานคนไทย 4.0 และสำนักงานการวิจัยแห่งชาติ ที่กรุณาสนับสนุนการพิมพ์ครั้งที่ 2 เพื่อเป็นสาธารณประโยชน์

คณิสร์ แสงโชติ

กรกฎาคม 2566

การเงินบนบล็อกเชน

หนังสือเล่มนี้ได้รับการสนับสนุนตีพิมพ์โดยแผนงานยุทธศาสตร์เป้าหมาย (Spearhead) ด้านสังคม คนไทย 4.0 สนับสนุนโดยสำนักงานการวิจัยแห่งชาติ (วช.) และตลาดหลักทรัพย์แห่งประเทศไทย

ISBN: 978-616-398-888-1

พิมพ์ครั้งที่ 1 พฤศจิกายน 2566 1,000 เล่ม (คลิกเพื่อดาวน์โหลด)

Money, Contract, and Stablecoin

Strengthening Economic and Financial Regulations for the Next Generation

Future of Money

(National Conference of Economists) ครั้งที่ 15

Book Talks

at the Stock Exchange of Thailand

DeFi

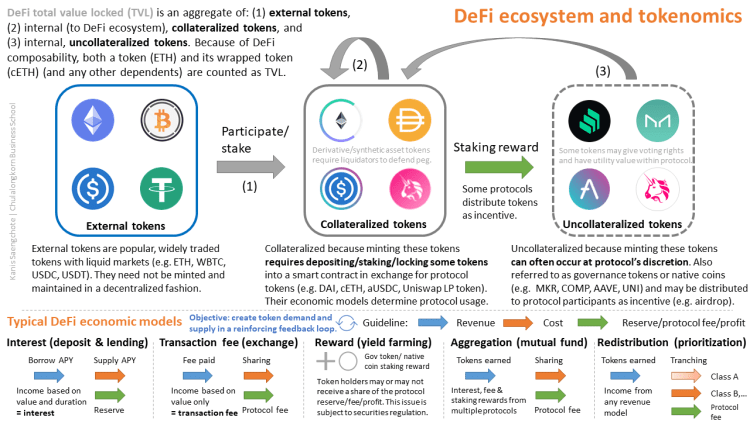

Blockchain technology and tokenization allow information to flow and interact in a decentralized manner. Tokens can come together to replicate traditional financial services in decentralized finance (DeFi).

For a Master’ s-level introduction to DeFi, please try the following videos, which are part of the Alternative Investment course of the MS Finance programme at Chulalongkorn Business School, Chulalongkorn University. The talks were given in January 2022.

And a more recent talk on why cryptocurrencies gain popularity and how they perform as “money.” This is also for the MS Finance programme at Chulalongkorn Business School, Chulalongkorn University. The talk was given in September 2022.

Factor Investing

Stocks that earn systematically higher returns in a consistent manner often share similar characteristics (e.g. book-to-market ratio). Factor investing is an outcome of asset pricing research that fundamentally seek to understand what drive asset returns. In a sense, it’s one of the simplest form of data-driven investing.

Click here to access Thailand’s Factor Library and Interactive Data Visualization, supported by Thailand Capital Market Development Fund (CMDF), Thailand Capital Market Research Institute (CMRI) and the Stock Exchange of Thailand (SET).